U.S. Financial Services Innovation: Digital Customer Onboarding Powered by Remote Node.js Devs

In the fast-evolving U.S. financial services sector, efficient and secure customer onboarding is crucial for attracting and retaining clients. Traditional onboarding processes, often reliant on manual verification and paper-based workflows, can be slow, error-prone, and frustrating for users.

CloudActive Labs helps financial institutions modernize onboarding processes by leveraging remote Node.js development teams to build digital, compliant, and user-friendly solutions that streamline client acquisition while maintaining regulatory standards.

Why Digital Customer Onboarding Is Essential

Digital onboarding enables financial institutions to:

- Enhance User Experience: Provide a fast, seamless, and intuitive registration process for new customers.

- Ensure Compliance: Meet regulatory requirements such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

- Reduce Operational Costs: Minimize manual processing and administrative overhead.

- Accelerate Account Activation: Enable clients to start using services immediately, improving satisfaction and retention.

- Support Scalability: Handle increased customer volume without compromising efficiency or security.

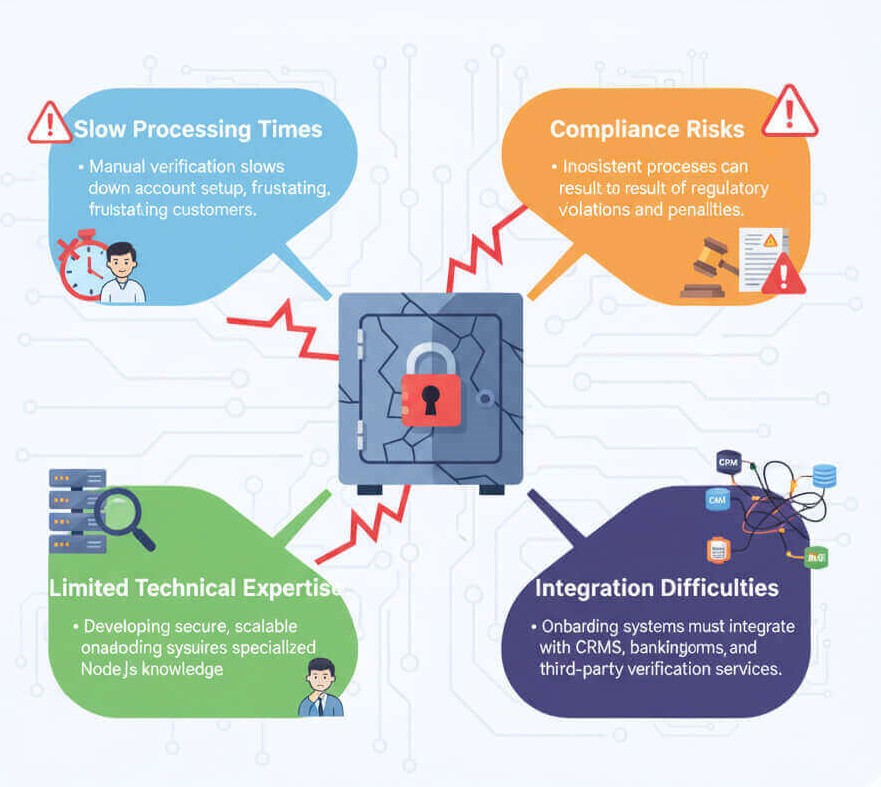

Challenges Faced by U.S. Financial Institutions

Traditional onboarding methods and legacy systems present several hurdles:

- Slow Processing Times: Manual verification slows down account setup, frustrating customers.

- Compliance Risks: Inconsistent processes can result in regulatory violations and penalties.

- Limited Technical Expertise: Developing secure, scalable onboarding systems requires specialized Node.js knowledge.

- Integration Difficulties: Onboarding systems must integrate with CRMs, banking platforms, and third-party verification services.

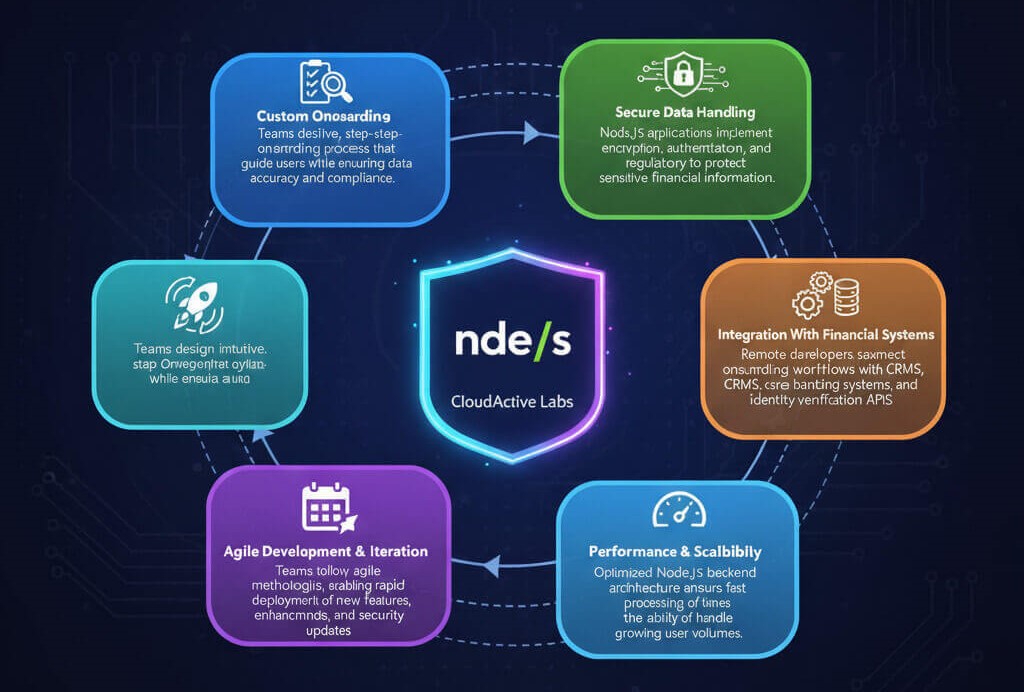

How Remote Node.js Teams Drive Digital Onboarding Innovation

CloudActive Labs’ remote Node.js developers provide comprehensive solutions to modernize onboarding:

- Custom Onboarding Workflows

Teams design intuitive, step-by-step onboarding processes that guide users while ensuring data accuracy and compliance.

- Secure Data Handling

Node.js applications implement encryption, authentication, and regulatory safeguards to protect sensitive financial information.

- Integration With Financial Systems

Remote developers seamlessly connect onboarding workflows with CRMs, core banking systems, and identity verification APIs.

- Performance & Scalability

Optimized Node.js backend architecture ensures fast processing times and the ability to handle growing user volumes.

- Agile Development & Iteration Teams follow agile methodologies, enabling rapid deployment of new features, enhancements, and security updates.

Benefits of Partnering With CloudActive Labs

Financial institutions leveraging CloudActive Labs’ remote Node.js teams gain:

- Faster Onboarding Times: Reduce customer wait times and improve satisfaction.

- Regulatory Compliance: Build secure, compliant processes that meet KYC and AML requirements.

- Scalable Solutions: Easily adapt to increased client volume and new regulatory needs.

- Cost-Effective Expertise: Access specialized talent without the overhead of local hiring.

- Enhanced Customer Retention: Seamless onboarding experiences increase engagement and loyalty.

Conclusion

Digital customer onboarding is no longer optional for U.S. financial services—it is a strategic advantage. By leveraging remote Node.js development teams from CloudActive Labs, institutions can deliver fast, secure, and compliant onboarding experiences that delight customers and reduce operational complexity.

CloudActive Labs empowers financial organizations with dedicated remote Node.js talent, agile processes, and secure architectures to innovate customer onboarding and drive business growth.

Ready to transform your financial onboarding processes with remote Node.js developers?

Contact us: [email protected]

Visit: www.cloudactivelabs.com